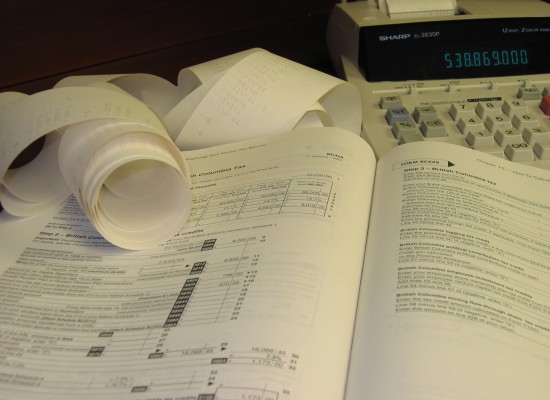

What Happens if I Keep Incomplete Tax Records?

As a tax accounting firm in Toronto, we’ve seen all levels of tax record-keeping from our clients—to the very diligent, to the wildly incomplete. You want to keep your tax records as organized and accessible as possible. Having this information at your finger tips is essential to properly gauging how your company is performing or

Read More