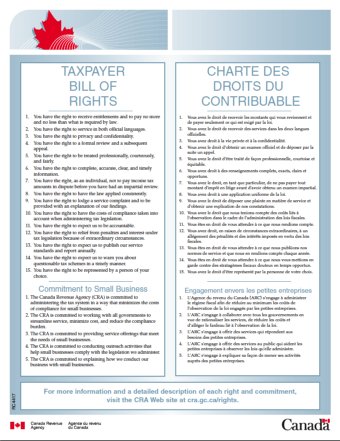

What is Included in Canada’s Taxpayer Bill of Rights?

Taxpayers in Toronto and the rest of Canada have rights. But what exactly does that include?

The Taxpayer Bill of Rights is a set of 16 rights that you have in your relationship with the Canada Revenue Agency.

Canadian Taxpayer Rights

As a Canadian taxpayer, you have the right to:

• Receive entitlements and to pay no more and no less than what is required by law

• Service in both official languages

• Privacy and confidentiality

• A formal review annually

• Expect us to warn you about questionable tax schemes in a timely manner

• Be represented by a person of your choice

• Lodge a service complaint and request a formal review without fear of reprisal and a subsequent appeal.

• Be treated professionally, courteously, and fairly

• Complete, accurate, clear, and timely information

• Not to pay income tax amounts in

dispute before you have had an impartial review

• Have the law applied consistently

• Lodge a service complaint and to be provided with an explanation of our findings

• Have the costs of compliance taken into account when administering tax legislation

• Expect us to be accountable

Earlier this summer, the Federal Government announced the addition of a new right to the Taxpayer Bill of Rights. Under the new right, if taxpayers lodge a service complaint or request a formal review, they can be confident that they will be treated impartially, receive the benefits, credits, and refunds to which they are entitled and pay no more and no less than what is required by law.

If you have any questions about our accounting or tax services, please don’t hesitate to contact our Toronto office at any time.