GST/HST 101 for Charities and Not-for-Profit Organizations

What is GST/HST?

GST/HST is a type of value-added tax. In theory, should apply to all consumption irrespective of whether the supplier is in the for-profit or non-profit sector. There are special GST/HST provisions for the non-profit sector to exempt certain “public good” or non-commercial-like activities in an attempt to minimize the compliance burden for the sector.

Supplies by charities = are exempt unless specifically excluded from exemption.

Supplies by other non-profit organizations = are taxable unless the supply is prescribed to be exempt.

- Supplies can be:

- Exempt

- Taxable at normal rates

- Zero-rated

- For supplies, each organization must determine:

- Which, if any, of its supplies are exempt;

- Which supplies are taxable;

- Under what conditions; and

- At what rate.

- For inputs, each organization must determine:

- Which qualify for input tax credits; and

- Which do not

- NPOs are subject to many of the rules applicable to the for-profit sector:

- Input tax credit restrictions

- Change-of –use rules

- Registration

- Filing and remittance requirements

- NPOs also have specific provisions directed at the non-profit sector

What are Public Service Bodies?

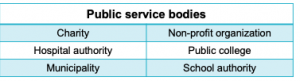

Public service bodies refers to all the entities that make up the non-profit sector. A public service body is either a government (federal or provincial); or a public service body.

For charities, the majority of property and services supplied are exempt from GST/HST.

Charities – Specific Exemptions

- Supplies of used or donated goods

- Provision of new goods in exchange for donation, no GST/HST on portion which qualifies for donation receipt

- Short-term rentals of residential accommodation

- Exempt admissions

- Direct cost exemption

- Most goods and services sold in course of fundraising activities

- Gambling events

- Memberships

- Recreation programs

- Grants and subsidies

Charities – taxable supplies

- Sale of new goods for a profit

- Rentals and leases

- Admissions to a place of amusement (> $1)

- Memberships that entitle members to benefits

NPOs – taxable supplies

- Majority of goods and services

- Membership fees

- Sponsorships

- Registration for conferences, educational seminars and trade shows

- Rental income

- Books and magazine subscriptions

When is a Charity or NPO Required to Register for GST/HST?

- Everyone must register for GST/HST if:

- Provide taxable supplies in Canada; and

- You are not a small supplier.

- Not necessary to register if:

- You are a small supplier;

- Only commercial activity is the sale of real property; or

- You are a non-resident who does not carry on commercial activity in Canada.

When are NPOs and charities – considered a small supplier?

NPOs & Charities are considered a small supplier if:

- Gross taxable supplies < $50,000 for previous 4 consecutive calendar quarters

- Charities also have $250,000 gross revenue test

As a small supplier you cannot charge GST/HST on taxable supplies or claim ITCs on related expenses. You can however claim public service bodies’ (PSB) rebate, if applicable.

The definition of “taxable supplies” includes:

- Worldwide revenue that would be subject to GST/HST if you made the supply in Canada

- Revenue from zero-rated supplies

Charities & NPOs must register within one month from the effective date you cease to be a small supplier.

Revenue – Importance of tracking

The potential implications if you do not track revenue include:

- Failure to charge GST/HST

- CRA assesses you for failure to charge GST/HST

- Difficulty in collecting GST/HST after the fact

- Missing potential GST/HST ITCs

It’s important to track revenue and worldwide taxable supplies

Voluntary registration

As a small supplier, you must provide taxable supplies (not exempt supplies). Most do not want to register either because of compliance or fears of losing competitive advantage.

If you decide to register, you must charge GST/HST on all taxable supplies, have ability to claim ITCs on related expenses, and must continue to be registered for at least 1 year.

Qualification as a small supplier

- Last four calendar quarters test

- Once $50,000 threshold exceeded in any calendar quarter:

- Must register and begin to collect tax on the 1st day of 2nd month in subsequent calendar quarter

- Once $50,000 threshold exceeded in any calendar quarter:

- Calendar quarter test – exception to above general rule

- Total revenues from taxable supplies in particular calendar quarter exceed $50,000

- Must register and collect tax, beginning with supply in which threshold exceeded

Are Directors Personally Liable for GST?

Directors of incorporated public sector body are jointly and severally, or solitarily, liable, together with the corporation, for any GST/HST the corporation fails to collect or remit. Liability extends to directors for two years subsequent to their leaving office. Excused from liability if exercised a degree of care, diligence, and skill to prevent GST/HST collection and remittance failures. Liability extends to:

- Officers

- Management committee members

- Members of an unincorporated entity

Members have an absolute liability, which cannot be waived or eliminated by exercising due diligence.

Charities – net tax calculation

- As GST/HST registrant, special net tax calculation is mandatory

- Remit 60% (line 105) of GST/HST charged on taxable supplies

- Unable to claim an input tax credit on expenses relating to taxable activities except for capital property

- May claim the PSB rebate for expenses you are unable to claim an input tax credit

- Capital property consists of buildings, furniture and equipment

- Claim full input tax credit on capital property if used more than 50% in your commercial activities

- No input tax credit if capital property used less than 50% in your commercial activities

Charities – election not to use net tax method

Charities have the ability to elect not to use net tax calculation if:

- 90% or more of your supplies are taxable,

- You make supplies outside of Canada, or

- You make zero-rated supplies

- Complete Form GST488

Charities are:

- Eligible to claim ITCs for GST/HST paid on expenses related to commercial activities

- Does expense relate to a specific activity?

- If taxable supply, claim the ITC

- If exempt supply, do not claim the ITC

- Overhead and operating expenses are allocated between taxable and exempt activities in a “fair and reasonable” way

- Allocation must be consistent throughout the year

Usually, if taxable sales are greater than related expenses, it is better to use the net tax method.

Input tax credits (ITCs) – GST/HST registrants

As a registrant, you must remit GST/HST charged. Charitable organizations have ability to claim ITCs for GST/HST that was paid on expenses related to providing a taxable supply. You are eligible to claim a PSB rebate for GST/HST paid that was not recoverable through claiming ITCs. Note, however, that ITCs are not available on expenses relating to exempt supplies

Many groups are involved with both taxable and exempt activities. Expenses can be classified as direct or indirect:

- Direct expenses associated with a taxable supply qualify for an ITC

- Indirect expenses need to be allocated between taxable and exempt supplies as an input tax credit may be taken on those expenses associated with a taxable supply

If all or substantially all (more than 90%) of expenses relate to taxable supplies (able to claim full input tax credit) or exempt supplies (no input tax credit available), you will need to allocate expenses between taxable and exempt supplies and claim input tax credits accordingly.

The CRA does not prescribe any one method of allocation. Examples of allocation methods include square footage, cost, number of employees, revenue earned and number of transactions. Allocation methods must be fair, reasonable, consistent, and documented. Entitlement to rebates will impact claim of ITCs.

What are public service bodies’ (PSB) rebates?

NPOs that are eligible to claim the PSB rebate include:

- Charities

- Public institutions

- Qualifying NPOs – where government funding is at least 40% of total revenue

- Municipalities, universities and school and hospital authorities.

The PSB rebate is 50% of the Federal portion (5%) of the HST on eligible expenditures. In Ontario, a rebate of 82% of the Provincial portion (8%) of the HST. Therefore, in Ontario the net HST is reduced to 3.94%. You do not have to be a GST/HST registrant to qualify for the rebate.

Charities must complete Federal form GST66 and Provincial form RC7066 and file them together. If not registered for GST/HST, file forms semi-annually; otherwise with GST/HST return. NPOs must also complete form GST523-1 concerning government funding. Forms can be filed online.

Rebate on out-of-province expenses

- Rebate depends on location of permanent establishment (“PE”)

- If PE is in an HST Province (Ontario), then one can claim rebate on Provincial portion of HST in other Provinces (Nova Scotia)

- In non-harmonized provinces, rebate only on Federal GST (5%)

Other noteworthy items

- File returns online

- Review GST/HST obligations annually at a minimum

- Ensure that you are claiming the maximum PSB rebate

- Consider making a voluntary disclosure with CRA

- You have 4 years to file for a PSB rebate or claim an input tax credit

- Seek professional advice

- Be aware that CRA has increased GST/HST audit activity

- Complex rules surrounding the disposition of real property. If your organization is selling or buying real property, you must consider the GST/HST impact.

- Consider a Section 211 election if you receive rental income from real property.

Want more information on GST/HST for charitable organizations? Contact the accountants at Hogg, Shain & Scheck to discuss the needs of your organization further.