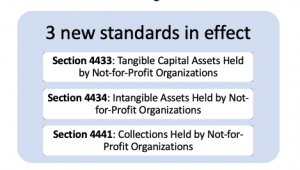

Accounting & Auditing Standards Update for Charities & Not-for-Profit Organizations

3 new & revised accounting & auditing standards for charities & not-for-profit organizations

- Fiscal years beginning on or after January 1, 2019

- Early adoption permitted

- 2017 annual improvements to existing ASNFPOs

Section 4433 & 4434: Tangible & intangible capital assets held by charities & not-for-profit organizations

- The roof of an owned building

- HVAC system

Each tangible asset is to be tracked and amortized separately based on the individual useful life. Not-for-profit organization should allocate asset costs using relative fair market value at:

- Date of original acquisition, or

- Date of adoption of the standard

Whichever is more readily determinable.

Write-downs for impairment of tangible and intangible assets are now required when there are conditions that suggest partial impairment may exist. Previously, write down was only required when there is no future long term service potential of an asset. The auditing standards update requires an assessment of whether the value of future benefits or service potential is less than the current carrying amount.

Write down to replacement cost or fair market value applies on an assess by asset basis. Write downs are recognized as a current period expense except for existing assets with partial impairment existing on the day of adoption of the auditing standard. Those are to be recognized as a reduction to net assets.

What you can do to prepare for the auditing standards update:

- Identify any assets with major component parts;

- Determine the relative cost of each component by:

- Retrieving original purchase details or market info at that time

- Finding current market info on the value of similar component parts

Section 4441: Collections held by Charities & Not-for-Profit Organizations

Collections help by charities and not-for-profit organizations currently not required to be recorded by ASNFPOs.

Examples of collections held by Charities & Not-for-Profit Organizations:

- Artwork

- Rare items not easily purchased

New policy provides a choice to recognize all collections as either: Cost, or Nominal value. If cost is chosen, but entity cannot determine this amount for old collections held, then they can opt to use nominal value. Not-for-profit organizations also need to continually assess collections for partial impairments.

2017 Annual Improvements to ASNFPOs

-

Section 1505

- Disclosure of accounting policies should be one of the first notes vs currently should be the first note

-

Section 1506

- Amount of adjustment to prior period must be disclosed vs currently not a requirement to disclose

-

Section 1521

- Formalized requirements that should appear on the statement of financial position

New auditor’s report

Detailed Information from CPA Canada

Changes to the accounting and auditing standards are aimed at providing more clarity and details on the roles of:

- Management

- Those charged with governance of the organization

- Auditor

- Effective for year ends on or after

- December 14, 2018

Key audit matters

In the auditor’s professional judgment, updates were of most significance in the audit of the entity’s financial statements of the current periodand are required to be disclosed by regulation or law (i.e. these will be mandatory for publicaly listed companies but optional for NPOs).

Key matters communicated with those charged with governance (TCWG) and placed in a separate section of the auditor’s report

New auditor’s report: What you can do to prepare

- Circulate wording of the new report with your Board

- Discuss whether any key audit matters exist with your:

- Audit partner

- Audit or finance committee

- Board of Directors

- Draft wording of any such key audit matters well in advance of due dates

- Seek approval of such changes early from those charged with governance

Re posted from Presentation of Alex Briganti, CPA, CA

Partner, Assurance & Advisory Services

Hogg, Shain & Scheck CPAs on October 30, 2018 at the HSS Navigating for Social Impact at Artscape Sandbox

Disclamier: This presentation does not constitute formal professional advice. The contents are for general information purposes only and under no circumstances can be relied upon for legal decision-making. Attendees and readers are advised to consult with a qualified accountant and obtain a written opinion concerns the specifics of their particular situation.