Can I Scan Tax Documents Like Gas Receipts?

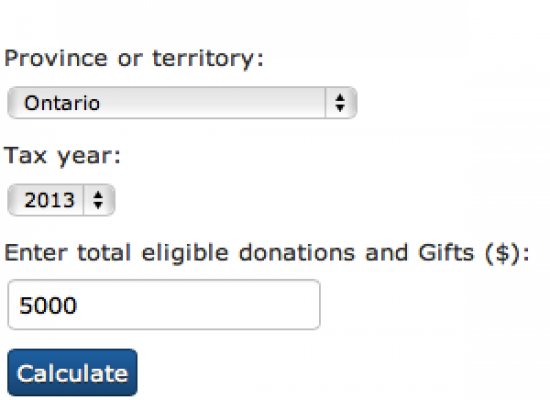

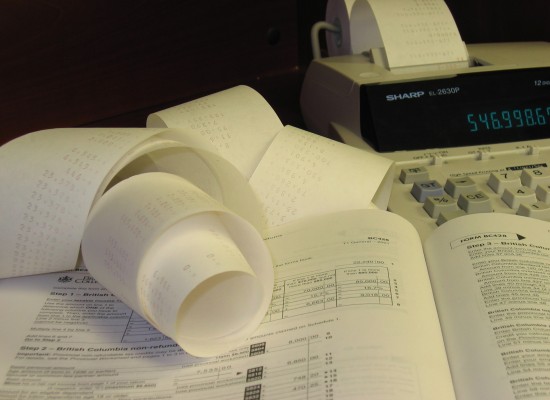

If you do a lot of traveling, or commute into Toronto for work, you’re going to accumulate a lot of gas receipts for tax purposes. Anyone who has had to keep gas receipts knows how quickly they can fade. So, many of our tax accounting clients ask us if it’s acceptable to scan their records

Read More